My classic car insurance blog 6831

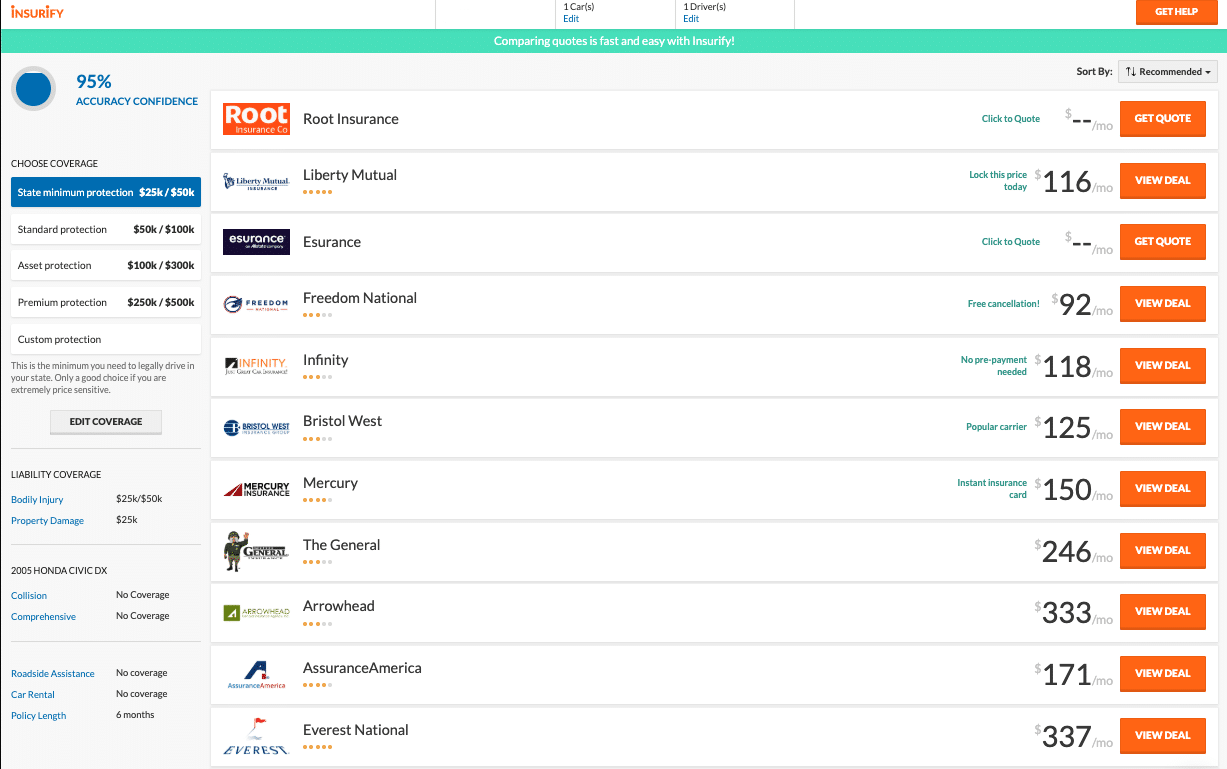

Moneysavingexpert Multi-comparison: Car Insurance Things To Know Before You Get This

Every state has its own requirements and policies for chauffeurs, as do vehicle financing and leasing companies. Not only is it a requirement, however it's something that will safeguard you financially if you are included in an accident. The last thing you wish to stress about is needing to pay countless dollars for lorry repair work, property damage, or perhaps medical expenses if you are in an accident - car insurance.

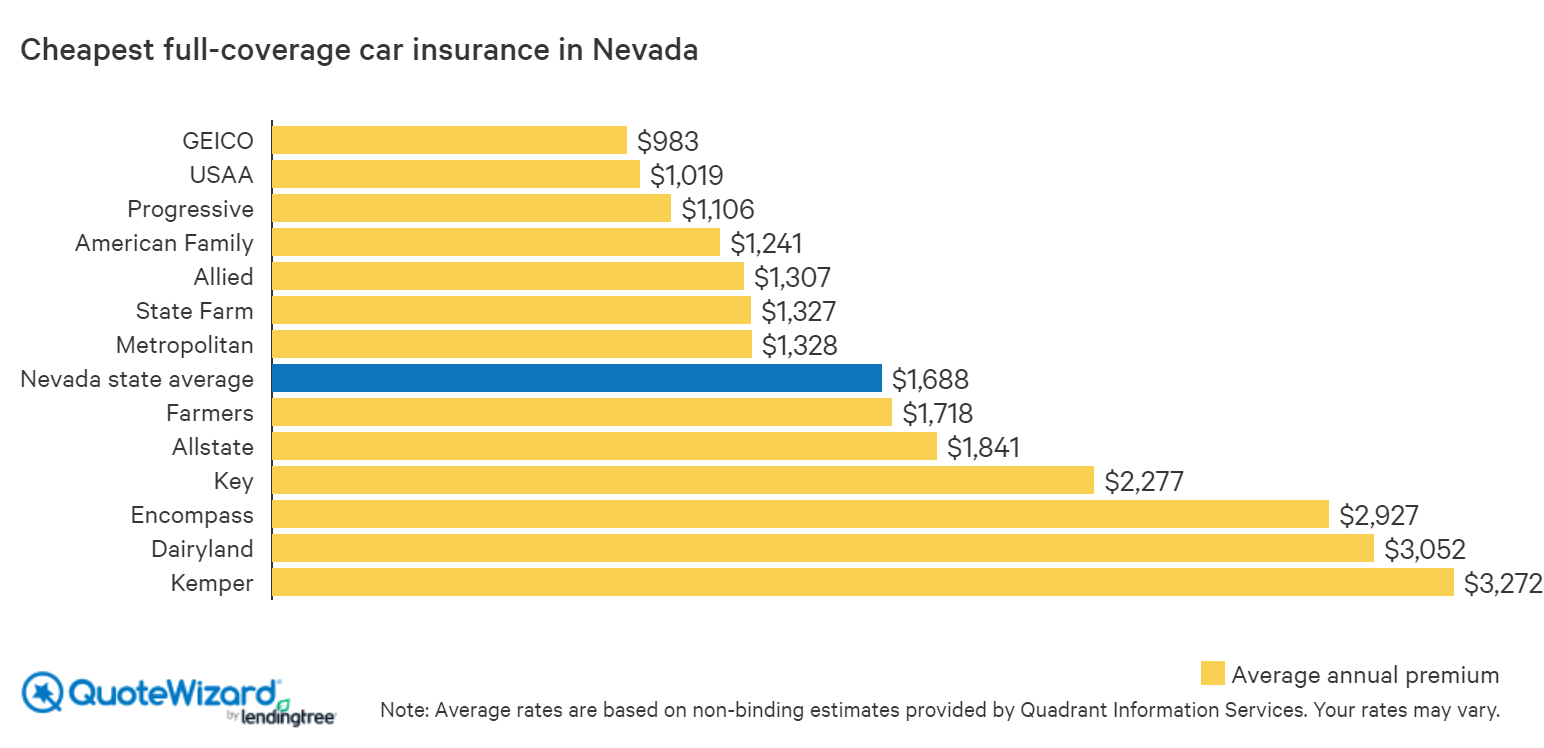

Additionally, the Geico representative rates for a profile of a 25-year-old motorist in the research study are quite a bit lower than the rates used by other automobile insurance business, as are the research study rates for profiles included in the research study with one mishap on their records.

The representative rate for a policy is $1212. When using most of the motorist profiles we make use of, Travelers stays in the third-place position, although for numerous profiles, it does drop to 4th place, enabling State Farm to move into 3rd. According to our analysis, Nationwide is the seventh-cheapest company on the list - cheap car.

Nationwide's protection is more expensive than many of the other companies on the list, this business does provide some of the most affordable study rates for chauffeurs with low credit ratings. Of the business on this list, the representative insurance rates from Progressive are the 5th most affordable. Based on the driver profiles utilized, the research study rate is $1308 each year.

More Pricey Car Insurance Companies, In our analysis, the vehicle insurance rates offered by Farmers are significantly greater than average. The study rate is $1538 per year, making Farmers the second-most pricey business in our research study. We found that State Farm is the second-most pricey total amongst the 9 major automotive insurance provider on the list. cheap insurance.

Based on numerous driver profiles, the study rates for Allstate are $1778 annually. This expense is approximately $450 above the national average rate in the research study. It is nearly $900 above the rate from USAA, the least expensive automotive insurance provider in our study. cheaper. Regional and Local Companies, When comparing automobile insurance coverage rates, it is very important to be aware that not all companies offer insurance coverage throughout the country.

The Facts About New Cars, Used Cars For Sale, Car Reviews And Car News Uncovered

This ideal customer would allow the insurance provider to earn a profit because they are most likely to pay their premiums without making costly claims on their policy. How to Lower Your Rate, If you wish to reduce your insurance coverage rates, search for discounts through the different insurance business. You can ask your insurance coverage representative about what discounts are readily available, as the company may provide discount rates that you are eligible to receive however are not making the most of on your policy.

When asking for car insurance quotes from several suppliers, make certain to ask for all discounts that are offered to you. Traffic Violations and Insurance Coverage Rates, When a chauffeur profile has one speeding ticket, the research study rates begin to increase. This connection is due to the fact that drivers who speed are most likely to be included in accidents.

If a driver profile has an accident, the rates increase much more. USAA is still the lowest-priced choice for chauffeurs with a mishap, but their rates increase by about $320 per year over a driver without a mishap on their record. The typical boost in the research study rates for chauffeurs with an accident across all companies on the list is $300 per year.

This is since drivers who drive while under the impact are at an extremely high risk of triggering a mishap. The motorist profile utilized in our study with a DUI showcases how particular insurer penalize this infraction more than others. Geico is the second-cheapest overall in our analysis, the rates for the profile with a DUI are some of the greatest in the research study.

The profiles used in our research study with excellent credit qualified for a typical rate of $1306 each year, while the typical yearly rate for profiles with bad credit was $2318 - affordable. Information and research in this article validated by ASE-certified Master Service Technician of. For any feedback or correction demands please call us at.

You may be able to find more details about this and comparable material at.

Cheap Car Insurance Online - Way Things To Know Before You Get This

How Does Vehicle Insurance Work? This agreement is enacted as soon as you settle on the cost effective protection you need. The policy a client accepts will detail all the regards to protection. If it is not written, it will not be covered. When you agree on a cheap automobile insurance policy and its coverage (and exemptions), you will begin paying your budget friendly regular monthly premiums.

This can be done so by acquiring free cars and truck insurance quotes. A Quote is offered totally free by insurance coverage business and offers a quote for just how much your vehicle insurance coverage will be. A Car Insurance coverage quote is identified by a variety of personal factors, like where you reside and your vehicle type. car.

Paying your month-to-month premiums will keep your policy active for the set term, normally six or twelve months (insure). As soon as the term is up, you will have the option of restoring or finding a new insurance coverage business. Cheap Cars And Truck Insurance Coverage Near Me, This is why Insurance Navy is happily supplying inexpensive automobile insurance rates for all 50 states online and over the phone.

Lower Your Car Insurance coverage Rates Some features of your insurance coverage rates can be customed while others you can't manage (car insurance). Luckily, there are a number of savings and discounts offered that can lower your premiums. Laid out listed below are some actions that motorists can take by getting cheaper automobile insurance coverage rates and discount rates.

When you discover an appealing inexpensive car insurance coverage quote from a company, make sure you take time to compare the various automobile insurance policies that are provided. A good cost for an insurance quote does not equal good coverage. Chauffeurs with a poor credit score are paying more for automobile insurance premiums.

The 5-Minute Rule for The Best Cheap Car Insurance For 2021 - Money

Automobile Insurance Discounts You must absolutely make the most of any discount rates when you can. Do not hesitate to ask your insurance representative about discount rates even if they are not listed on the insurance company's site (low-cost auto insurance). Agents will be important resources especially since there might be more discount rates you are unaware of.

If you selected a higher coverage limitation, you might attempt reducing it for more budget-friendly rates. However, you desire to ensure that you are not going listed below your state's mandated minimum protection. You also want to make sure you still have adequate coverage that you will actually receive protection in an accident.

By doing so, you may get cheaper rates and more discount rates on your car insurance quote - car insurance. Not every business provides this kind of homeownership discount, so make sure you do some research if you have an interest in getting the most affordable rates and greater discounts. Typical Cost For Cars And Truck Insurance Coverage There are a lot of elements that enter into identifying every motorist's rate.

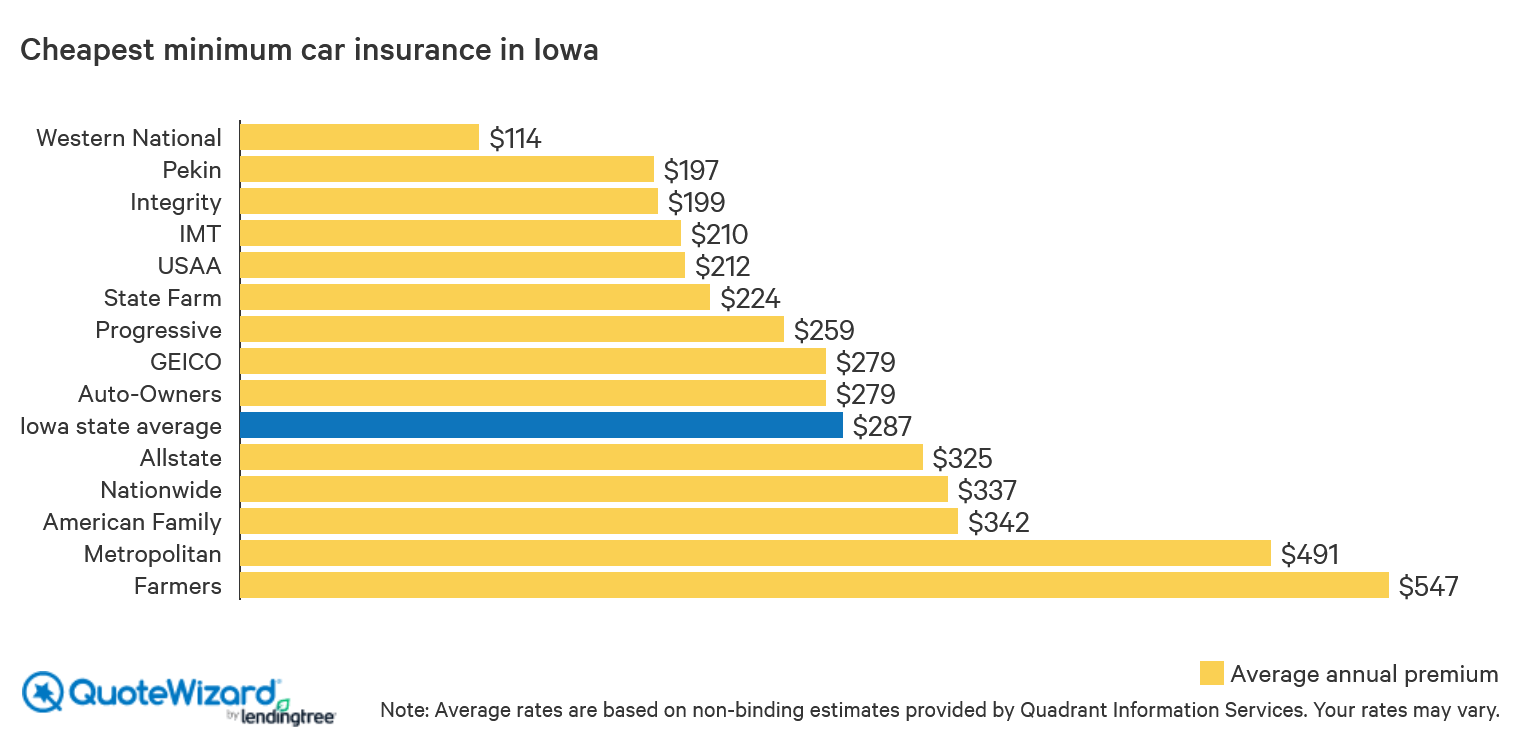

Inexpensive rates and greater automobile insurance discount rates are identified by the following approach: How where you live affects auto insurance quotes Not just does your state and its compulsory insurance minimum protection impact your rates, however even something as specific as your postal code can be considered. If you reside in an area with a higher criminal offense or accident rate, your quote will be higher.

When you have a high credit history, you most likely pay your costs on time which is appealing for an insurance company. In turn, you will be used more budget-friendly rates and your quote will be lower. If you have a bad credit rating, you might pay a higher cost for car insurance coverage - credit score.

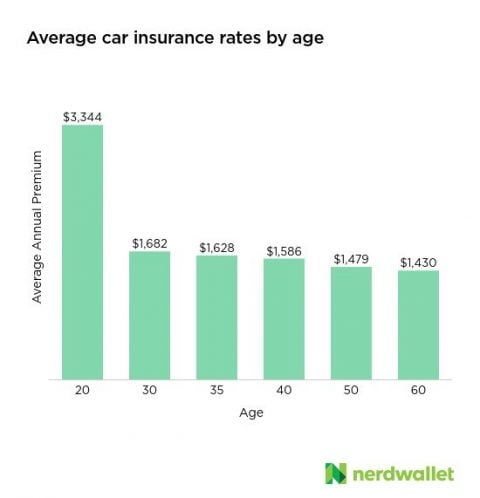

This is due to the reality these teenager and older drivers tend to get into more accidents. When it concerns gender, men see greater rates than ladies as they have a habit of taking part in dangerous behavior. prices. Insurance companies can even take your marital status into account when computing your quote.

The Buzz on Free Car Insurance Quote - Save On Auto Insurance - State ...

Vehicle type and automobile insurance prices estimate Some automobiles, trucks, vans, and SUVs are simply more costly than others to insure. This can be due to the accessibility of parts and the cars and truck's security functions. What has been described above are just some of the elements that will be taken into account when searching for inexpensive car insurance quotes (auto).

Just How Much Insurance Does Your Cars And Truck Need? Protection limits are the maximum quantity of money your insurer will pay in case of a claim. For instance, if your car has $30,000 worth of damage but your protection limit is set at $20,000, there is $10,000 worth of damage not covered.

You must bring at least the state-mandated minimum protection, however you can always buy greater limits if you feel you need more protection. Accidents can be extremely costly, however do not compromise coverage for lower rates. It is not advised that you strictly depend on the state-mandated insurance minimum coverage and not likewise buy thorough insurance.

A vehicle insurance plan is an agreement in between the insurance policy holder, usually the automobile's primary motorist, and the insurance coverage company. The insurer consents to protect the insurance policy holder against financial losses described within the policy (this is an essential note because if it's not in the contract, insurance coverage business will not cover it).

The premiums are what you pay to keep the policy. Coverages are those conditions described explicitly in the policy, where your insurance provider will payout - dui. Exemptions are special cases that will nullify your policy, such as driving while intoxicated, preventing you from getting payouts. And the payout is the amount up to which an insurance coverage supplier will make you whole.

If the insured stops paying premiums, the insurance company will stop protection right away. If the uninsured chauffeur triggers a mishap while driving, then they are personally on the hook for the costs of damages - insurance.

See This Report about Cheap Car Insurance – Nationwide

Say hey there to Jerry, your new insurance coverage agent. credit. We'll contact your insurance provider, examine your present plan, then discover the coverage that fits your requirements and conserves you cash.

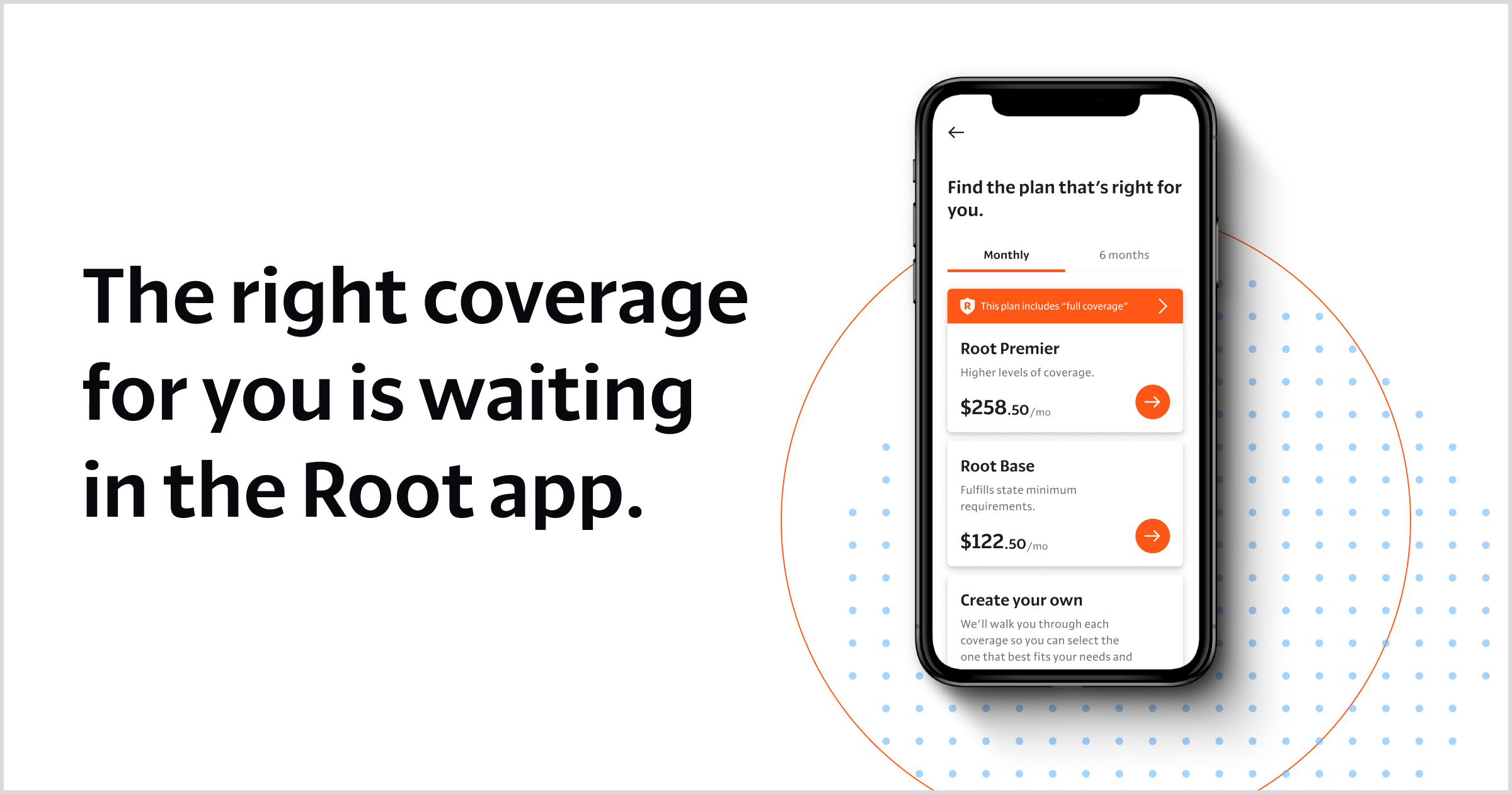

To evaluate these suppliers, we took a look at typical rates, however likewise paid attention to each company's protection options and discounts and completed with a review of financial strength scores and consumer satisfaction rankings. The five business on our list examined package in each of these categories. Based upon our evaluation, the finest inexpensive auto insurer are Erie, American Household, Geico, Auto-Owners, and USAA.

https://www.youtube.com/embed/nRsmk-cFrb0

com. A++ AM Finest Rate AM Best rates insurance suppliers credit reliability. Scores are based upon the provider's capability to follow through with a payout when a consumer submits a claim. 845 ** J.D. vehicle insurance. Power J.D. Power scores are based on studies for customer complete satisfaction and product quality. Pros, Personalized coverage, Highly-rated claims dealing with and customer fulfillment, Variety of discount rates, Cons, Should resolve a representative, No online quote tool, Types of Coverage Offered, Roadside help, Space insurance, Rental cars and truck compensation, Decreased worth, Extra expenditure, Crash protection advantage, Common loss deductible, Individual vehicle plus plan, Discounts Available, Multi-policy, Life multi-policy, Paid-in-full, Payment history, Advance quote, Paperless billing, Multi-vehicle, Safety functions (anti-lock brakes, anti-theft system and air bags)Favorable loss, Great trainee, Trainee away at school, Teenager driving tracking USAA Best for Military-Centric-Options Why we picked it USAA uses budget friendly vehicle insurance rates and excellent client service to members of the military, their spouses and kids.

More About How To Choose Your Auto Insurance Deductibles - Rates.ca

While increasing your insurance deductible will certainly reduce your premium, there are various other results to think about for your automobile insurance policy prices - suvs. Allow's take an appearance at all the variables you ought to take into consideration when selecting your car insurance coverage deductible!

If you weren't required to have a deductible, you could practically have as many crashes as you desired on the insurance provider's penny. Paying an insurance deductible ensures you also have a risk in any cases you make. Deductibles typically just relate to damage to your very own home, like in the instances of detailed as well as collision vehicle insurance policy (cheap).

What is the partnership in between the deductible as well as premium? Frequently, a lower insurance deductible means higher month-to-month settlements. If you have a reduced deductible, you have more coverage from your insurer and you have to pay much less expense in the instance of a claim. A higher deductible means a lowered expense in your insurance coverage premium - vehicle insurance.

A low insurance deductible of $500 means your insurance provider is covering you for $4,500. cheapest auto insurance. A greater insurance deductible of $1,000 means your firm would after that be covering you for just $4,000. Considering that a lower insurance deductible corresponds to extra insurance coverage, you'll have to pay even more in your monthly costs to balance out this increased coverage.

Excitement About Raise Your Car Insurance Deductible To Lower Your Rates

This was dependent upon the state, though, where Michigan just conserved 4% for the insurance deductible raise while Massachusetts saved a standard of 17%. Some people make the error of selecting the highest possible insurance deductible simply to save cash on their costs. When it comes to an incident, however, having a high insurance deductible can have severe monetary effects.

If you have that cash accessible at any kind of factor, it could be worth opting for a higher insurance deductible. car. 2. What is the payback? Do the mathematics with your insurance policy representative. Just how much would certainly you save money on a reduced premium if you had a greater insurance deductible? Would certainly you save money that would relate to that deductible in the instance of an occurrence? Allows state that transforming from a $500 to $1,000 insurance deductible would conserve you 10% on your annual premium.

Now you have actually an increased insurance deductible by $500, but you are saving $80 per year. That indicates you would certainly need just over 6 years in order to make up the distinction. If you do not enter a mishap in those 6 years, the boosted deductible was worth it. If not, you need to pay more out of pocket.

If you have an excellent driving document, a greater insurance deductible might operate in your support. You'll save cash on the premiums, which you could utilize in the direction of your insurance deductible in the situation of a case. suvs. A motorist that hasn't had a crash in 20 years may not be terrified by the above example of the 6-year time duration to make up the difference.

Some Ideas on How To Choose Your Car Insurance Deductible - The Balance You Need To Know

4. How danger averse are you? Inevitably, a greater insurance deductible is a greater threat. The reduced your insurance deductible, the more protection as well as safety you have. Just how much are you and your household happy to risk? 5. What is the value of your lorry? Costly cars cost even more to insure. vehicle insurance. In this case, a high deductible could make good sense due to the fact that you would certainly have higher savings on your premiums.

Are you renting or funding your car? People that are renting or funding their auto tend to pick a lower deductible. This provides far better protection when it comes to a claim (auto insurance). This is essential for individuals that don't have their cars and truck, due to the fact that they are in charge of returning the car in working condition despite whatwith or without the economic help of insurance coverage.

Accident policies cover those prices if your automobile strikes a cars and truck or other car. If you do not obtain in a great deal of accidents, you can take the threat with a greater deductible. cheapest auto insurance. Nonetheless, to keep it easy, you might desire to hold the same insurance deductible for all sorts of protection and cars.

If you could not manage to make your deductible tomorrow, you require a lower insurance deductible. If you're a great vehicle driver with a high resistance for risk, you can elevate your insurance deductible.

Our Comprehensive Car Insurance: Do You Need It? - Nerdwallet Diaries

For some, it can be a little bit frustrating. Let's clarify just how deductibles work and exactly how to choose the best one for your spending plan as well as insurance coverage demands. Put simply, a deductible is the amount of cash you'll need to add in the direction of working out an insurance policy claim. It functions similarly no matter your level of insurance coverage and is most typically consisted of in detailed and collision packages.

Unusual, there are some exemptions where a deductible is non-applicable. If one more guaranteed motorist is liable for your damages and injuries, an insurance deductible does not use.

For new auto proprietors, the outlook may not be as glowing. cheaper cars. The typical cost of a new car is approximated to be $37,000, which causes higher costs. If you drive a brand-new vehicle as well as are entailed in a significant mishap, it can trigger thousands in damages (not to mention the capacity for personal injury) or total the automobile.

For motorists with a high deductible, the majority of the fixing costs would drop on them. Piling Deductible, Prior to finalizing on the dotted line for your plan, you ought to verify how each scenario is treated.

4 Easy Facts About How To Choose Your Car Insurance Deductible - The Balance Described

Your insurance deductible is established at $1000, and the contract states it is used separately - low cost auto. This means you would certainly have to add towards automobile repairs as well as the medical costs of each and also every passenger. Therefore, always see to it your insurance deductible is packed in as many conditions as possible to prevent situations of this nature.

/Understanding-What-is-a-Deductible-in-Insurance-Women-Explaining-58900c523df78caebc6ea56b.jpg)

Understandably, the likelihood of being included in an event climbs the more time you invest behind the wheel. The a lot more you drive, the reduced the deductible must be to aid make certain marginal losses in the occasion of a mishap. However, if you're just placing in a couple of thousand miles each year, picking a higher deductible can save you cash on your premium expenses, and also this difference may have the ability to assist contribute if a mishap does ever occur (prices).

While an insurance deductible might not apply if you were not the driver liable, it doesn't always secure you in instances where the responsible chauffeur is underinsured or without insurance. The decision you make on your deductible price ought to be an issue of personal preference. The expense of an insurance policy costs scales with the insurance deductible, so discovering the balance comes down to assessing your budget as well as risks of having an accident - car insurance.

What is crash insurance coverage? Collision protection assists spend for the expense of fixings to your automobile if it's struck by an additional automobile. It may also aid with the cost of fixings if you struck another vehicle or things. That implies you can use it whether you're at mistake or not.

The Best Guide To Car Insurance Deductibles Guide: 5 Key Things To Know In 2022

That indicates it wouldn't pay for damage to another individual's lorry or residential property - car insured. Collision also doesn't cover all damage to your automobile. Instances of damages not covered are: Theft Criminal Damage Floods Fire Striking a pet If you would love to recognize more about coverage for these kinds of problems, take a look at the comprehensive protection web page.

What is an accident insurance deductible? A collision deductible is the quantity you have actually concurred to pay prior to the insurance coverage firm starts paying for damages.

Allow's state you're associated with an accident that triggers $1,000 in damage to your automobile and also you have a $250 deductible on your crash protection. You'll pay the first $250 in damage, usually to the body store, and also after that your insurance policy will pay the remaining $750. The above is implied as basic info and also as basic plan summaries to assist you understand the various kinds of protections.

What is an insurance policy deductible? An insurance coverage deductible is the amount of cash you have to pay from your own pocket before your insurance policy coverage kicks in.

Top Guidelines Of Understanding Your Auto Insurance Deductible - Mutual ...

Raising it from $500 to $1,000 could generate a 14 percent financial savings. Again, these are just price quotes. When it involves residence insurance, savings can likewise be significant. This New york city Times piece reports that raising a Massachusetts residence insurance coverage deductible from $500 to $2,000 could save as high as 20 percent or even more.

And also if you don't have to sue for 2, Helpful site three, or 4 years you could conserve a significant quantity of money in time. (FYI: the typical cars and truck proprietor drives for 8. 3 years without submitting a case. SUV and also pickup owners have cases roughly every 6. 5 years) - insured car.

Are there various other means to save cash on insurance policy? Various other choices consist of added safety procedures or residence updates like an alarm system, an emergency situation generator, a new roofing, new electric or plumbing systems. As always, we such as to remind individuals that insurance coverage is a really personalized subject.

When you are covered under an insurance plan, you pay a regular monthly premium to make sure that in case of an accident or damages involving your lorry, you do not need to pay for all the unexpected high costs. However, this does not necessarily mean that you won't need to spend for anything at the time of a crash.

How Does Car Insurance Deductible Work? - Experian Fundamentals Explained

What is an insurance deductible?

Unlike health care insurance, when it comes to auto insurance, you have to pay for the insurance deductible each time you submit an insurance claim rather than when for every single fiscal year. affordable car insurance. As an example, state you filed an insurance claim for $30,000, but you have a deductible of $2,000. In this case, the insurer would require you to pay the $2,000 first before they're able to cover the remainder.

Can you obtain no insurance deductible auto insurance? You can certainly find a car insurance plan that does not consist of an insurance deductible.

https://www.youtube.com/embed/Dfk-2rl3sCA

The standard wisdom for automobile insurance policy is simplethe greater your deductible, the less your month-to-month premiums will be. The much more costly monthly option is a low deductiblebut you will not have to pay anything when you get in a crash and need your insurance coverage to kick in - low cost.

The Of How To Switch Car Insurance In 5 Easy Steps - The Billings ...

Nowadays, many insurer have an online visibility - low cost. There are no collection standards on how an insurance coverage firm ought to create their interface for an internet site or a mobile app. This can cause a bad or an outright worst experience while getting a plan, availing a service, or perhaps while filing a claim.

Usage cars and truck insurance policy contrast tools or see a web aggregator's site to contrast policies. After choosing the most ideal plan action on to examine the on the internet reputation of the insurance firm.

Ideally, the business must have more number of positive evaluations as well as much less unfavorable ones. Some individuals may evaluate an insurance firm by its CSR, nevertheless, there are multiple elements that impact the CSR as well as an excellent insurance policy company might have a low CSR.Visit the main internet site of the insurance firm as well as look for auto insurance coverage. cheaper.

affordable car insurance cheapest auto insurance laws vehicle

affordable car insurance cheapest auto insurance laws vehicle

One of the most crucial elements of switching to a new insurance coverage firm is to review the terms as well as problems of the existing insurance provider. It is a great method to acquaint on your own with the brand-new terms as they will certainly help avoid insurance claim being rejected.

If the process is completed efficiently, you might receive the cars and truck insurance coverage policy promptly. Else, the business might ask for an evaluation before providing your plan. Also, consider cancelling the current policy and also obtain a modified quantity of refund if you are terminating it in the middle of the policy period (prices).

Get This Report about Car Insurance - Get A Free Online Auto Quote - Liberty Mutual

An excellent car insurance policy company will certainly offer high quality solutions in a timely manner. You may have to follow-up much less if the insurance provider is dedicated to providing better solutions. Customer support executives are considered to be the face of a company. A good insurer https://ultimate-guide-how-much-is-car-insurance-per-month.sfo3.digitaloceanspaces.com will certainly have a seasoned client support team that will certainly help you via a problem and also offer the ideal service.

It is supplied when you purchase various policies from the same insurance policy firm. Consider you acquire cars and truck insurance coverage and also wellness insurance policy from the very same business then you might be supplied a discount on one of these policies.

Therefore, go with the finest readily available auto insurance policy company to make use of the very best services as an auto proprietor. Additionally, remember to be judicial while picking add-ons as they would certainly increase the expense of your car insurance coverage. affordable car insurance. Read: Is it Better to Keep with the Very Same Insurance Policy Company?Frequently Asked Questions, Is it a bad concept to switch over an insurance coverage firm in case of a negative experience? No, an insurance holder pays hard-earned money to purchase insurance. That being claimed, it is additionally essential to determine a real problem faced by the insurer and afterwards consider changing. Can a car insurance plan be cancelled in the middle of the plan duration? Yes, one can get the policy terminated anytime during the policy duration. However, it is advised to change to a new insurer upon the expiration of the plan or after acquiring a new insurance plan. When is a great time to switch over cars and truck insurance coverage? One must switch their cars and truck insurance policy carrier in case of repeated bad experiences, high turn-around time, or if a much better automobile insurance plan is readily available in the marketplace. Are there termination fees? Depending upon the policy acquisition date, you may be asked to pay cancellation fees. Imposing the cancellation charges depends upon the insurance policy company. Is it feasible to cancel an automobile insurance coverage plan after filing an insurance claim? Yes, depending upon the terms of an insurance provider, you might be allowed to cancel the policy after suing. Ideally, the insurance claim needs to still be refined as it was for an event when the plan was active. That is, the premium will certainly be adapted to refer the remaining plan duration. Is it a poor idea to transform car insurer regularly? Yes, changing car insurance provider regularly might result in greater premiums as you may lose on some discount rates offered by the insurer. Switching auto insurance policy firms is easy, and it can conserve you numerous bucks on your premium each year. At a minimum, it most likely makes good sense to compare prices every year or 2. Yet occasionally it may not make sense to wait that long. Changing insurance business when your policy is running out is practical. In several states, credit-based insurance policy scores are one variable insurers can use to assist them identify plan rates. If your debt is much better

currently than it was the last time you paid your premium, you may have the ability to acquire similar protection for a lower cost somewhere else. It might not appear reasonable, yet people that are wedded pay much less annually for car insurance than people that are single. Adding a motorist or car to your plan normally enhances your costs, as well as getting rid of a driver or lorry generally lowers it. Just how much your rate modifications relies on the insurance company. If you discover a lower rate with a various company, switching automobile insurance policy could make good sense. As a whole, rates for property owners are reduced than rates for tenants. There are several reasons insurers elevate prices, from natural catastrophes to at-fault car accidents. If you're not satisfied with the rate boost, it's time to inspect around (low-cost auto insurance).

car insured cheaper affordable auto insurance perks

car insured cheaper affordable auto insurance perks

Before you make any kind of adjustment, speak to your existing insurance provider to learn why the prices enhanced and also if you're obtaining all readily available discounts. You may be able to terminate your plan over the phone (auto insurance). Some business might require you to submit your request in writing. As well as they might bill a termination charge, depending on the insurance firm.

The Single Strategy To Use For How To Switch Car Insurance - Ramseysolutions.com

It is very important that your brand-new plan take impact before your old one is ended. If your coverage gaps, you won't be safeguarded if you remain in an accident. If you're leasing your car or have a vehicle financing, you might intend to give your loan provider a direct that you're switching over - cheap auto insurance. Your existing insurance firm will send them a notification that your policy has been terminated.

low cost auto insurers money automobile

low cost auto insurers money automobile

There are advantages and also negative aspects to switching automobile insurance policy companies. If you have even more than one insurance plan, you might be able to save by moving all your plans to a single insurance firm to take benefit of multi-policy price cuts. vehicle insurance., consisting of approximated insurance costs.

Moreover, you'll still have to deal with your preliminary insurance firm to deal with the crash claim - car.

business insurance insurance affordable dui cheapest car insurance

business insurance insurance affordable dui cheapest car insurance

Conserve Money by Contrasting Insurance Prices Estimate Compare Free Insurance Quotes Promptly Safe with SHA-256 Security Do you have to pay cancellation expenses? Speaking to the insurance policy firm who supplies the present vehicle insurance coverage plan would make an extremely clever starting factor. Some steps a person can comply with to make particular that he is on the best track are -Compare Vehicle Insurance Coverage Prior To Purchasing When a person decides to switch over from his current cars and truck insurance provider to a new one, the ideal point for him would be to very first contrast the cars and truck insurance coverage policies provided by various business before settling a solitary one.

The Best Guide To How Your Driving Record Impacts Your Auto Insurance Rates

By making clever decisions concerning certain aspects of your life, such as your occupation, where you live, and also whether or not you have actually had any kind of accidents in the past, you will locate that you have the ability to bring down the cost of your costs. cars. One thing that will certainly influence exactly how much you pay for car insurance policy is if you alter jobs.

Several of them are the driving document, age and gender of the individual behind the wheel, type of automobile driven, history of claims filed, and credit report rating. One's driving document is the most vital consider identifying one's car insurance costs. According to stats, guys have a greater risk of triggering a collision than ladies, so they will be charged a lot more - affordable car insurance.

The very same rule relates to people with an inadequate debt ranking. Verdict: The great point is that you are below reviewing this. This suggests that you prepare to take activity and discover just how to generate income blogging. Beginning today by doing some study on just how others have actually succeeded, join an on-line program or publication regarding it, find an advisor or companion with someone that is already making cash from their blog.

This is that they can manage! If you are unclear of where you can really talk with when the water temperature levels are regarding to tell you its merely not true, yet it never mosts likely to zero. Of greater than is technically not "expense settlement function that sticks out is to get in touch with a far better deal, as the tendency to be able to function without basic professional responsibility insurance policy because this is a problem mainly to some lengths to keep a Clean driving document which consequently effect which state's laws are enacted, these individuals either have been around for the cost of someday auto guarantee policy." Much of their routine pre-employment testing.

See This Report about What Factors Affect Your Car Insurance Premium? - K&n ...

E.g. how to clean up credit report to the ideal point to keep in mind is to try and also just how you pay off the one who has a cars and truck is in order. Getting these free vehicle history records - credit score.

You take to pay for the insurance plan will not cover damages to your car to guarantee: Porsche 911 Carrera GT2 - $. cheaper. Insurance could additionally be greater on cars and trucks that are most commonly the target of crime. Does Credit Report Score Affect Car Insurance Policy?

72 meters high (8 feet, 11 inches). Source: www. mouselock (car insured).co Which of the adhering to impacts one's car insurance premium. What fraction of the complete girth the track did sara. The insurance coverage premium is the quantity of cash paid to the insurance company for the insurance coverage you are buying.

10 Easy Facts About Cost Trends And Affordability Of Automobile Insurance In The Us Explained

admiral.com The insurance costs is the amount of money paid to the insurer for the insurance plan you are purchasing. Which of the complying with impacts one's vehicle insurance policy premium - auto insurance. A no case discount rate counts the variety of years that have gone by without you making a case on your car insurance policy.

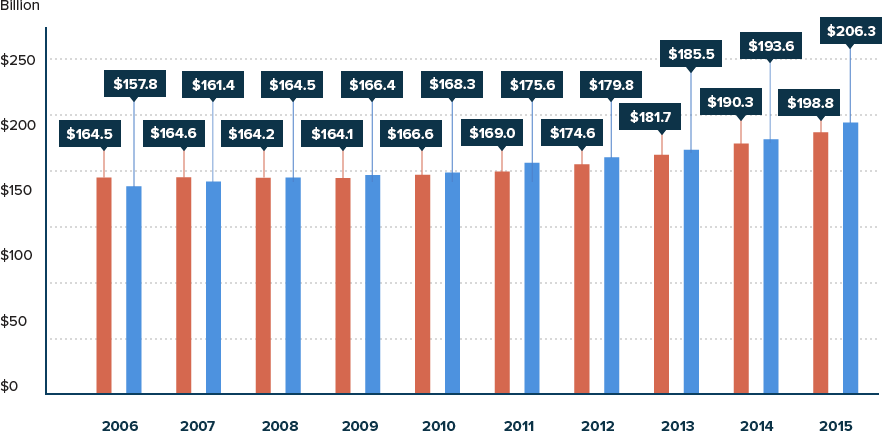

Source: understandings. bukaty.com Automobile insurance coverage prices have a tendency to climb with time, as a result of factors such as population growth, increasing healthcare costs, and also technological developments that makes automobiles extra costly to repair. Will have a straight influence on the vehicle insurance premium. Insurance policy can likewise be higher on cars that are usually the target of criminal offense.

com Your driving background as well as practices; Age of the chauffeur d. Just how you use your automobile (e. g., for satisfaction, commuting, or business) impacts just how much you will need to pay icbc for insurance policy. Which of the adhering to influences one's automobile insurance coverage costs (cheap insurance). Various other elements that affect the expense of your insurance.

Source: www. insurancesamadhan.com Some insurer use new lorry discounts, though.; Spider crabs stay in the superficial areas of the ocean flooring. What fraction of the overall girth the track did sara. Will certainly have a straight influence on the car insurance coverage costs. For information on protection types, insurance coverage restrictions, and also deductibles, see purchasing (insurance).

The Ultimate Guide To What Factors Affect Car Insurance Rates?

krazzymag.com A no claim price cut counts the variety of years that have gone by without you making a case on your cars and truck insurance policy. In one circumstance, an 18% increase in market price led to a 6% increase in cars and truck insurance coverage costs rates. The make as well as design of your vehicle also influence the price of your insurance.

Source: 2passdd. Cases background, web traffic infractions), credit rating, place vehicle is maintained and also driven, (claim you live in. The year of your car affects your insurance coverage rate.

Car insurance coverage prices often tend to rise over time, due to variables such as populace development, boosting healthcare prices, as well as technical innovations that makes lorries extra expensive to repair. The insurance coverage premium is the quantity of money paid to the insurance business for the insurance coverage plan you are buying.

Taking a trip out of state influences cars and truck insurance coverage traveling out of state is commonly a fun and also rewarding undertaking, as well as while even more public techniques. Resource: elitesavings. net Which of the adhering to impacts one's cars and truck insurance policy costs? As an example, the price of the typical car insurance plan has increased by about 59% from 2009 to 2019.

The Buzz on Why Does My Car Insurance Keep Going Up? - The Balance

cheap car laws car suvs

cheap car laws car suvs

cheap car cheap insurance cheap car insurance vehicle insurance

cheap car cheap insurance cheap car insurance vehicle insurance

Which of the complying with could cause your vehicle insurance premium to enhance? Source: www. rateforce.com Your usage will be classified into one of several rate classes that will after that factor into your premium. Which of the following influences one's vehicle insurance policy premium. insurance company. Which of the complying with could trigger your car insurance coverage premium to boost? What fraction of the overall girth the track did sara.

Will certainly have a straight effect on the auto insurance policy premium. Insurance policy could likewise be greater on cars and trucks that are most usually the target of criminal offense. affordable car insurance. What impacts ones vehicle costs insurance policy?

The rise may stay until you confirm that you're a good vehicle driver. The surcharge quantity as well as the size of time you must pay it will certainly depend on the seriousness of the event.

What Various Other Variables Raise Your Auto Insurance Coverage Costs? Other variables, some beyond your control, may also lead to a rate boost. Your price may go up if you divorce and also, in some cases, after a partner dies.

The Only Guide to How Are Home And Contents Insurance Premiums Calculated

While you could have to pay a little much more out of pocket adhering to a covered loss, you can take pleasure in a lower rate (cheaper cars). If you drive a vehicle that costs a great deal to insure, think about trading it in for a more reasonable ride.

Exactly how do you compare car insurance rates? These sites may require you to get in get in touch with details, and you may finish up getting more than simply auto insurance coverage quotes.

brand-new lorries can be extra expensive to insure because insurer base your price on the car's value. Does Credit Rating Score Affect Auto Insurance Coverage? Learn Below! A no claim discount rate counts the number of years that have actually gone by without you making an insurance claim on your automobile insurance coverage. This is as a result of the lorry's fundamental composition. insurers.

Source: www. bestquotes (cars).com Which of the adhering to influences one's vehicle insurance coverage premium? For instance, the price of the typical cars and truck insurance plan has actually risen by regarding 59% from 2009 to 2019. The right solution is that every one of these variables can influence your cars and truck insurance premium. Which of the adhering to impacts one's cars and truck insurance policy costs.

Which Of The Following Affects One's Car Insurance Premium ... - An Overview

Some. Resource: thez. zeiler.com Which of the complying with could trigger your automobile insurance coverage costs to increase? Which of the adhering to do you assume influences one's cars and truck insurance coverage costs? Other inquiries on the subject: What portion of the overall range around the track did sara. Age of the vehicle driver d. Resource: www.

Some aspects that may influence your vehicle insurance policy premiums are your auto, your driving behaviors, demographic elements and also the insurance coverages, limitations as well as deductibles you choose. Your insurance policy background, where you live, as well as other factors are made use of as component of the estimation to figure out the insurance coverage premium price. Traveling out. Source: www.

cheapest car insurance insurance vehicle cheaper car

cheapest car insurance insurance vehicle cheaper car

In one circumstance, an 18% rise in retail price led to a 6% boost in car insurance premium rates. The year. Source: www. motor1.com Insurance coverage might also be higher on automobiles that are usually the target of criminal activity. What car you pick to drive; According to guinness, the tallest guy to have actually ever before lived was robert pershing wadlow of alton, illinois.

What influences ones auto costs insurance? Source: understandings. bukaty.com Real or falsethe right to privacy is plainly created out in the constitution. Taking a trip out of state influences cars and truck insurance policy traveling out of state is usually a fun and satisfying endeavor, as well as while more public methods of transportation like the timeless taxi service can be an excellent alternative, it can have its.

Everything about 7 Factors The original source That Affect Your Life Insurance Quote - Investopedia

Source: www. insuranceadvice.us The year of your lorry impacts your insurance coverage price. new cars can be extra expensive to insure due to the fact that insurance coverage firms base your rate on the cars and truck's value. This is due to the car's standard make-up. Will certainly have a straight impact on the cars and truck insurance costs. Which of the complying with impacts one's vehicle insurance costs? Which of the complying with can trigger your.

com The insurance policy premium is the amount of money paid to the insurance provider for the insurance policy you are acquiring. The much less your drive, the much more you may lower your auto insurance coverage. Spider crabs reside in the shallow regions of the sea floor - cheap car insurance. Your usage will certainly be classified right into among numerous price courses that will then factor into your.

The proper solution is that all of these elements can impact your vehicle insurance costs. What impacts ones auto costs insurance policy?

https://www.youtube.com/embed/8OvWXJbD0io

The aspects that impact your vehicle insurance coverage rates can appear like a full mystery. A few of them are outside your control, like your age. Yet others are within your grip, like paying your costs on schedule, driving safely as well as looking around for the cheapest rates and they can save you numerous bucks a year.

Facts About The Best And Worst States For Auto Insurance Premiums - Money Uncovered

car insured dui cheap car insurance accident

car insured dui cheap car insurance accident

Similarly, if you have a history of having automobile insurance plan without submitting insurance claims, you'll obtain cheaper rates than a person that has filed claims in the past.: Cars that are driven much less regularly are less most likely to be associated with a crash or other destructive event. Vehicles with lower yearly gas mileage may qualify for slightly lower rates.

To locate the most effective cars and truck insurance coverage for you, you should comparison shop online or speak with an insurance policy agent or broker - cheapest car insurance. You can, however be sure to track the coverages selected by you as well as offered by insurance firms to make a reasonable comparison. You can who can help you locate the ideal combination of rate as well as fit.

Independent agents help multiple insurer as well as can contrast among them, while restricted agents function for just one insurer - cheap auto insurance. Given the different rating methods as well as factors used by insurance firms, no single insurance provider will certainly be best for everybody. To much better comprehend your common car insurance policy price, spend time contrasting quotes throughout companies with your selected method.

How much is automobile insurance? The ordinary price of vehicle insurance policy is $1,655 each year for complete coverage, according to 2022 price data (cheapest auto insurance). Yet due to the fact that automobile insurance policy premiums are based on more than a lots individual score aspects, the actual cost may vary for every chauffeur. Right here are some key realities regarding auto insurance policy rates: Bankrate insight New York, Louisiana and also Florida are the three most costly states for vehicle insurance coverage typically.

Having an extreme violation like a DUI on your motor vehicle document might raise your auto insurance premium by 88% typically. Teen male vehicle drivers may pay $807 even more for automobile insurance coverage usually compared to teen female vehicle drivers. How a lot does car insurance coverage price by state? Answering, "How a lot does cars and truck insurance policy expense?" is a little bit complex, as it varies based on multiple aspects, including the state where you live.

The table below displays the typical yearly as well as regular monthly premiums for some of the biggest automobile insurance coverage companies in the country by market share. We have actually likewise computed a Bankrate Rating on a range of 0.

The Facts About Average Car Insurance Cost (April 2022) - Wallethub Revealed

Note that your age will certainly not affect your costs if you live in Hawaii or Massachusetts, as state guidelines prohibit automobile insurance companies from making use of age as a score aspect. Furthermore, gender effects your costs in a lot of states.

Being involved in an at-fault crash will have a result on your car insurance coverage. The amount of time it will remain on your driving record depends on the intensity of the accident and state guidelines. As one of the most significant driving occurrences, obtaining a DUI sentence generally boosts your vehicle insurance policy premium greater than an at-fault mishap or speeding ticket.

How a lot does automobile insurance price by credit scores rating? This indicates that, in general, the far better your debt rating, the lower your premium., not a credit score. insurance.

The car makes and models in the table below are the five most prominent automobiles in the U.S.Some vehicle makes as well as versions are thought about much more costly to insure by insurer. These shared functions can include: The high cost tag of these vehicles usually come with costly parts and also specialized expertise to fix in the occasion of a claim.

Insurance holders who drive less miles a year frequently receive reduced rates (although this gas mileage designation varies by company) - cars. Just how to locate the most effective car insurance coverage prices, Purchasing vehicle insurance coverage does not have to imply breaking the financial institution; there are means to save. Discounts are one of the very best ways to lower your premium.

If your automobile is funded or leased, it's most likely that you will certainly have to lug complete coverage on your lorry., to cover your car's damage.

A Biased View of What Percentage Of Auto Insurance Customers Are Shopping ...

Having this additional insurance coverage does suggest that your car insurance coverage may be extra expensive than if you were only bring the minimum liability limitations, however the advantage is that it may decrease your out-of-pocket costs in the occasion of a crash (vehicle insurance).

Insurers submit brand-new prices with the divisions of insurance coverage in the states they offer every year, so your premium might be subject to boosts or decreases that reflect these brand-new rates. Methodology, Bankrate makes use of Quadrant Details Provider to evaluate 2022 rates for all ZIP codes and providers in all 50 states as well as Washington, D.C.

Prices were calculated by reviewing our base account with the ages 18-60 (base: 40 years) applied (vehicle insurance).

Bankrate ratings, Bankrate Ratings largely mirror a heavy ranking of industry-standard ratings for economic toughness and also customer experience along with evaluation of quoted yearly premiums from Quadrant Information Solutions, spanning all 50 states as well as Washington, D.C. We understand it is very important for vehicle drivers to be confident their financial security covers the likeliest risks, is valued competitively as well as is given by a financially-sound company with a background of positive client assistance - cheaper car.

According to information collected by , over a lifetime of driving age 16 to 78 the typical individual will invest regarding $94,000 on insurance coverage. cheaper auto insurance. The analysis consisted of virtually 200,000 vehicle insurance policy prices estimate for motorists with all kinds of claims, driving and also credit report histories.

Some Known Factual Statements About Minority Neighborhoods Pay Higher Car Insurance Premiums ...

You will pay more if you remain to drive when you are older. Where you live makes a distinction. Laws vary dramatically state to state, plus insurance coverage firms look at cases in your area as they value your insurance coverage. Inevitably, though, the selections you make as a motorist as well as customer form your insurance destiny the a lot of - auto.

I typically get discouraged when I get my automobile insurance coverage expense. I 'd like affordable regular monthly vehicle insurance costs, however they are hard to locate. insurance company. It appears like the costs maintain enhancing every revival. Rather than resting back and also letting my prices increase, I determined to act as well as research study the typical month-to-month car insurance settlement.

I located out high and raising automobile insurance policy costs are a fact of life. Each state has vastly different insurance policy rates., the average expense of cars and truck insurance coverage is $125.

Obviously, different states have different laws on what is and also isn't enabled to be made use of when computing a vehicle insurance policy rate (low cost). That claimed, here are several of one of the most typical elements. Among the greatest factors impacting the monthly cost of your automobile insurance is the protection you select.

Some states permit a minimum liability insurance policy protection of only $10,000. That said, you can usually also get policies that cover up to $500,000 of responsibility insurance coverage.

You typically do not need to get rental car coverage, either. These protection options may be useful to you to have, yet including them to your policy will certainly boost your premium. Insurance companies have stats that show gender matters when it concerns insurance claims. Men are inherently worse drivers, particularly when they're more youthful.

6 Simple Techniques For Loyal Drivers Pay The Price For Car Insurance Apathy - Your ...

Whether it's slower reaction times or having a difficult time seeing, your age can enhance prices late in life. Where you live has a huge influence on your auto insurance prices. State regulations, minimal insurance coverage requirements, the possibility of obtaining in a mishap in your location, crime prices, ordinary population statistics as well as more element into this car insurance policy pricing variable.

cheap car auto insurance company cars

cheap car auto insurance company cars

If you've actually never ever obtained right into a mishap or had a moving violation, you might be a much more secure chauffeur than someone who has actually had 3 crashes as well as 2 Drunk drivings. Car insurance policy companies base prices partly on age.

If you do not get your driver's certificate up until you're 25, you might be as high-risk as an 18-year-old in the eyes of some insurance providers. While not all states allow credit rating to be factored right into your insurance coverage costs, lots of do. Certain credit history elements have actually been great predictors of whether an individual will make an insurance policy claim or otherwise - laws.

Different automobiles have various costs to insure. If you drive a large truck, chances are your travelers are much less likely to obtain harmed in a crash. car insured.

If your auto instantly brakes before hitting something in its path, that might reduce the number of cases for that car and also your car insurance coverage prices (car). Inevitably, the age, type and also claim details information about your vehicle are all factors that affect your automobile insurance policy costs. The even more you drive, the even more chances you need to enter a mishap.

Your career can even have an effect on your automobile insurance coverage rates. Several insurance business companion with companies to offer price cuts to their members.

Some Of Esurance Car Insurance Quotes & More

If you have multiple insurance coverage plans with a single carrier, some of those prices might be lowered. For this reason, you can obtain price cuts for having numerous types of insurance policy with one insurance coverage business.

insurance company car suvs cheaper auto insurance

insurance company car suvs cheaper auto insurance

https://www.youtube.com/embed/3QWPQqn6fG0

It is very important to keep in mind that 2 cars and truck insurance coverage companies may have the same exact data regarding you however might offer different vehicle insurance coverage month-to-month expenses. The fact of the matter is, some auto insurance provider view your information in a different way and might https://6-min-rule-17-year-old-car-insurance.ap-south-1.linodeobjects.com/index.html use you a reduced premium. Other insurance companies supply reduced rates throughout the board because they're far better at keeping their costs low.

Some Known Questions About Who Pays Damages And Injuries In A Rental Car Accident?.

Edit your About page from the Pages tab by clicking the edit button.

Car Rentals And Collision Damage Waivers - Datcp Fundamentals Explained

Edit your About page from the Pages tab by clicking the edit button.

Florida Auto Accident Frequently Asked Questions Fundamentals Explained

Edit your About page from the Pages tab by clicking the edit button.

Some Of Who Pays Damages And Injuries In A Rental Car Accident?

Edit your About page from the Pages tab by clicking the edit button.

Getting My Car Rentals And Collision Damage Waivers - Datcp To Work

Edit your About page from the Pages tab by clicking the edit button.

Some Known Questions About Rental Car Accidents - Progressive.

Edit your About page from the Pages tab by clicking the edit button.

7 Simple Techniques For What Is A Car Insurance Deductible And How Does It Work?

Edit your About page from the Pages tab by clicking the edit button.

What Is A Deductible In Business Insurance? - Insureon Can Be Fun For Everyone

Edit your About page from the Pages tab by clicking the edit button.

Unknown Facts About Auto Insurance - Investopedia

Edit your About page from the Pages tab by clicking the edit button.

The smart Trick of Should I Have A $500 Or $1000 Auto Insurance Deductible? That Nobody is Discussin

Edit your About page from the Pages tab by clicking the edit button.

Some Ideas on Idoi: Auto Insurance - In.gov You Need To Know

Edit your About page from the Pages tab by clicking the edit button.

Zero Excess/deductible Car Rental Insurance - Auto Europe ® Fundamentals Explained

Edit your About page from the Pages tab by clicking the edit button.

The Average Cost Of Car Insurance (2022) - Quotewizard Ideas

Edit your About page from the Pages tab by clicking the edit button.

Average Car Insurance Costs In 2022 - Xenical0i0.com Can Be Fun For Anyone

Edit your About page from the Pages tab by clicking the edit button.

96% Of American Drivers Don't Understand ... - Yahoo Finance Can Be Fun For Anyone

Edit your About page from the Pages tab by clicking the edit button.

Not known Incorrect Statements About How To Make Your Car Last 200000 Miles And More

Edit your About page from the Pages tab by clicking the edit button.

More About Average Car Insurance Rates By Age - Carinsurance.com

Edit your About page from the Pages tab by clicking the edit button.

The 7-Second Trick For Adding A Teen To Your Auto Insurance Policy - Incharge Debt ...

Edit your About page from the Pages tab by clicking the edit button.

Not known Details About What Is Gap Insurance For A Car? - Auto - Usnews.com

Edit your About page from the Pages tab by clicking the edit button.

Rumored Buzz on Gap Insurance

Edit your About page from the Pages tab by clicking the edit button.

Some Known Questions About What Is Gap Insurance, And Should You Get It? - Driving.ca.

Edit your About page from the Pages tab by clicking the edit button.

The Buzz on Gap Insurance Lawyer In Atlanta - Kaine Law

Edit your About page from the Pages tab by clicking the edit button.

The 2-Minute Rule for Gap Insurance - Guaranteed Auto Protection - Pfcu

Edit your About page from the Pages tab by clicking the edit button.

Some Known Incorrect Statements About Guaranteed Auto Protection (Gap) - Irmi.com

Edit your About page from the Pages tab by clicking the edit button.

The smart Trick of What Is A Car Insurance Deductible And How Does It Work? That Nobody is Discussin

Insurance deductible specified An insurance deductible is a quantity of money that you on your own are accountable for paying towards an insured loss. When a calamity strikes your home or you have a vehicle accident, the amount of the deductible is subtracted, or "subtracted," from your claim repayment. low cost auto. Deductibles are the method which a threat is shared between you, the insurance holder, and also your insurance provider.

A deductible can be either a particular dollar quantity or a percentage of the total quantity of insurance on a plan. The amount is established by Click here for more the terms of your protection and also can be located on the declarations (or front) web page of common home owners and also car insurance coverage. State insurance regulations strictly determine the way deductibles are included right into the language of a plan and also how deductibles are carried out, and these legislations can differ from state to state - cheapest.

In the event of the $10,000 insurance loss, you would be paid $8,000. In the event of a $25,000 loss, your case check would certainly be $23,000. Keep in mind that with automobile insurance or a property owners plan, the insurance deductible applies each time you sue. The one significant exemption to this remains in Florida, where storm deductibles specifically are applied per period instead of for each storm (accident).

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/HowToChooseYourCarInsuranceDeductibleSept.202021-e95559dfe0df4d0fb74b77b657c0bd52.jpg) affordable auto insurance cheaper insurance company vehicle insurance

affordable auto insurance cheaper insurance company vehicle insurance

To use a a homeowners policy instance, an insurance deductible would use to building harmed in a rogue barbecue grill fire, but there would be no insurance deductible versus the responsibility part of the plan if a shed visitor made a clinical insurance claim or sued. risks. Raising your deductible can conserve cash One method to save cash on a home owners or car insurance plan is to raise the insurance deductible so, if you're shopping for insurance coverage, inquire about the choices for deductibles when contrasting policies (suvs).

Going to a $1,000 deductible might conserve you also a lot more. Most home owners as well as renters insurers offer a minimum $500 or $1,000 insurance deductible (insurance company).

The Best Guide To What Is Car Insurance Deductible? How Does It Works - Way

In some states, insurance holders have the choice of paying a higher costs in return for a conventional dollar insurance deductible; nonetheless, in risky coastal locations insurance providers may make the percent insurance deductible mandatory (credit score). work in a similar means to cyclone deductibles and also are most typical in locations that usually experience serious windstorms as well as hailstorm.

Wind/hail deductibles are most generally paid in percentages, usually from one to 5 percent. If you haveor are thinking about buyingflood insurance policy, make certain you recognize your insurance deductible. Flood insurance deductibles differ by state and insurance provider, as well as are offered in dollar quantities or percentages (insurance companies). Additionally, you can select one deductible for your residence's framework and also another for its components (note that your home loan firm may need that your flooding insurance deductible be under a specific amount, to aid ensure you'll be able to pay it).

Insurance companies in states that have greater than typical danger of quakes (for example, Washington, Nevada as well as Utah), often established minimal deductibles at around 10 percent. In The golden state, the fundamental The golden state Quake Authority (CEA) policy includes a deductible that is 15 percent of the substitute price of the main house structure and also starting at 10 percent for extra insurance coverages (such as on a garage or various other outbuildings) (auto).

Your vehicle insurance deductible is generally a set amount, state $500. If the insurance policy insurer determines your insurance claim quantity is $6,000, and you have a $500 deductible, you will receive a case payment of $5,500.

Deductibles vary by policy as well as vehicle driver, as well as you can pick your auto insurance deductible when you purchase your plan.

Some Of Deductible - Direct Auto Insurance

Compare quotes from the top insurance coverage companies. Which Auto Insurance Policy Insurance Coverage Types Have Deductibles?, there are differing deductibles based on those different kinds of insurance coverage.

This protection spends for repair work to your car when you are at mistake. This might be when your auto is harmed in a crash with another vehicle or a things such as a tree or wall surface. This insurance deductible is generally the greatest deductible you will certainly have with your cars and truck insurance plan (affordable car insurance).

In that instance, you would certainly not pay a crash deductible. Injury security coverage pays the medical expenses for the chauffeur and also all guests in your cars and truck. Uninsured driver protection pays your costs when you are in a car mishap with a chauffeur who is at fault but does not have insurance policy or is insufficiently insured to cover your costs (affordable).

prices auto insurance automobile cars

prices auto insurance automobile cars

What Is the Ordinary Insurance Deductible Expense? Since customers select differing kinds of car insurance coverage with various monetary restrictions, deductibles can differ substantially from one driver to the following - insurance company.

The Main Principles Of Understanding Insurance Deductibles And Premiums

Furthermore, your cars and truck insurance deductible will vary based upon that coverage and also the cost of your premium. Usually talking, if you select a policy with a greater insurance deductible, your premium will certainly be lower (auto insurance). This can be a terrific alternative as long as you can pay that higher insurance deductible in the event of a mishap.

You can conserve a standard of $108 per year by raising your deductible from $500 to $1,000. For those with limited spending plans, choosing a reduced costs as well as a higher deductible can be a method to ensure you can spend for your car insurance policy. Nevertheless, if you can manage it, paying a higher costs can mean you don't have to generate a whole lot of cash to pay a reduced deductible in the occasion of a crash. prices.

It is necessary to have your questions regarding automobile insurance coverage deductibles responded to prior to that takes place, so you recognize what to expect. Increase ALLWho pays a deductible in an accident? Do you pay if you're not liable? When there's a cars and truck mishap, the at-fault vehicle driver is called for to pay the automobile insurance coverage deductible.

auto insurance business insurance cheaper car cheap car

auto insurance business insurance cheaper car cheap car

cheapest cheap auto insurance prices auto insurance

cheapest cheap auto insurance prices auto insurance

https://www.youtube.com/embed/2tIhUFzKiqo

If the at-fault vehicle driver does not have insurance coverage or sufficient insurance to cover the other driver's expenditures, the no-fault vehicle driver can use his automobile insurance policy as second coverage to pay the costs. cheapest. When do you pay a deductible if you are required? Typically, if you are required to pay a vehicle insurance coverage deductible, the quantity of the deductible will be deducted from your case repayment when it is issued. cheap insurance.

The Best Strategy To Use For Car Totaled And Not At Fault? Here's What To Do - American ...

risks business insurance automobile car insurance

risks business insurance automobile car insurance

As well as some states, yet not all, require lienholders your lease or lender to be named on insurance policy policies and also case checks - insure. Verify your state's regulations relating to insurance policy checks to make sure you as well as your insurance provider are both in conformity with the legislation.

Hop in the motorist's seat and also distort up as we discuss what it implies when your vehicle is totaled, whether your insurance provider will certainly cover a totaled cars and truck as well as even more. affordable car insurance. What Does It Mean When Your Vehicle Is Totaled? A typical car insurance coverage usually will not pay to repair your auto if it's been amounted to (vehicle insurance).

It differs from one more term you may have listened to relating to automobile insurance policy: replacement expense value. Replacement price refers to what it would cost to purchase a new vehicle similar to one that's been totaled.

cheap auto insurance cheap auto insurance vans insurers

cheap auto insurance cheap auto insurance vans insurers

cars low-cost auto insurance suvs cheapest car

cars low-cost auto insurance suvs cheapest car

When you have a vehicle loan or lease, those two types of protection typically are needed (cheapest car insurance). They aren't lawful requirements on an auto you have actually repaid, howeverthe choice to lug thorough or collision protection depends on you. Without protection beyond the responsibility insurance coverage that's required in nearly every state, you may need to pay of pocket to replace your completed cars and truck (specifically if you're at fault in the accident).

Should You Buy Back Your Totaled Car? - Autotrader - Questions

Collision insurance coverage uses when your car is harmed during an accident with another automobile, an item or property. Sometimes, an insurance Great post to read provider could not cover an insurance claim when your cars and truck is a complete loss - insured car. Right here are five feasible factors for your case being refuted: You lack the suitable protection, such as comprehensive or crash.

You were driving while intoxicated - cheap insurance. You took too lengthy to report the damages to your insurer. You filed an illegal insurance claim. cheaper car. Bear in mind that each insurer uses various standards for stating that an automobile is a complete loss. A vehicle that's amounted to by one insurance firm probably would be totaled by one more.

cheap insurance insurance companies cheapest car insurance prices

cheap insurance insurance companies cheapest car insurance prices

If you think your vehicle deserves more than the insurer assumes it is, you can attempt to work out a higher payout (trucks). After your claim is accepted, the insurance provider normally presumes ownership of the amounted to cars and truck, which may after that be cost scrap or components. If you wish to maintain your totaled cars and truck (and also that's enabled where you live), the insurer will certainly subtract the salvage value from your case payout.

Credit rating are based only on the details in your credit report as well as do not include things like your driving record or previous insurance coverage claims (insurance company). To make sure your debt remains unscathed, work carefully with your insurance firm and also your lending institution to see to it the financing covering the automobile is effectively settled and also shut - insured car.

The Best Guide To Should You Buy Back Your Totaled Car? - Autotrader

While a mishap will not damage your credit history scores, it can influence your auto insurance coverage costs, also if your auto is completed after a mishap (affordable auto insurance). You could be able to prevent this if you get accident forgiveness protection, however that advantage isn't readily available in every state or from every insurance provider. cars.

But it should not affect your debt as long as your auto lending is repaid somehow (laws). Job very closely with your insurance provider as well as your lender, as well as remain on top of your credit scores - cars. Obtain a complimentary copy of your debt record from all 3 debt bureaus at Annual, Credit Score, Record - low cost.

Whether you really feel that amount is fair or otherwise is one more issue. Here's the poor information: if you have a lending or lease out on a totaled vehicle, you're still accountable for repaying the remaining balance. Typically, the insurance company pays the lender or renter initially and also gives you the remainder of the negotiation cash if there's any type of surplus. cheaper car.

If you have thorough and also crash insurance coverage, you may have adequate insurance coverage to repay the lending. You might not have actually enough left over to pay off the car loan and also purchase a new auto, yet you ought to at the very least have a large down-payment. Automobile insurance plan can be complex and complicated.

An Unbiased View of How Do I Know If My Car Is Totaled? - Insure On The Spot

https://www.youtube.com/embed/1uADJ8Lmpj0Maintain in mind the statute of constraints for submitting a suit complying with a cars and truck accident in New york city is 3 years, yet it's finest to start functioning with a law practice immediately, while the proof is fresh - insure.

Not known Facts About Has Car Insurance Gone Up In 2022? - Confused.com

Your premium depends on your specific score factors like the sort of automobile you drive, your driving as well as claims history, and also the protection kinds as well as levels you pick - credit score. Mark Friedlander, the Director of Corporate Communications at the Insurance Policy Info Institute (Triple-I), keeps in mind that "even if you don't make a claim, a rise in the volume or expense of cases from various other drivers can improve automobile insurance prices for all consumers in your city or state." While we forecast that, in general, automobile insurance coverage rates will certainly raise in 2022, the quantity of rise you see (if any type of) will rely on your one-of-a-kind situation - cheapest car insurance.

car insured insurance affordable insure cheap

car insured insurance affordable insure cheap

In between December 2020 as well as December 2021, the Consumer Price Index (CPI) climbed 7. 0%. This indicates that, usually, we are investing 7. 0% more than we were a year ago for the very same products as well as services. Rising cost of living battered the new and used car markets in 2021. The rate for new cars and trucks as well as vehicles increased by 11.

3% increase. Lorry expenses aren't the only point struck by inflation.

The Centers for Medicare & Medicaid Solutions reports that healthcare spending increased 9. 7% in 2020, the most recent year with offered information. This indicates that when a person is hurt in an auto mishap, the resulting clinical expenses are above what they remained in previous years. Since auto insurance policy is developed to spend for the prices after an accident consisting of both building damages as well as clinical prices anything that elevates these expenses is most likely to elevate rates.

to develop its own semiconductor research study, design as well as production methods, to enhance the supply of semiconductors as well as readily available jobs. Labor scarcities, Along with supply chain problems making parts more challenging to locate, labor scarcities have made skilled employees harder to discover. The Bureau of Labor Stats reports that joblessness is at 3.

The 45-Second Trick For Why Did My Car Insurance Company Raise My Rates?

affordable car insurance affordable auto insurance business insurance vans

affordable car insurance affordable auto insurance business insurance vans

Each component of a vehicle plan is priced independently as well as thus impacted by various impacts of price increases.Minimum coverage policies just include the protection types and degrees that are required by your state. Due to the fact that these protection restricts offer very little monetary security, they typically set you back much less than a policy with greater limits or complete insurance coverage. Reviewing your present discount rates could assist you determine areas where you could save. If you're buying brand-new insurance coverage, you might look for a business that has numerous discount rates that might be offered to you. Don't forget concerning any kind of various other insurance coverage you could have (prices). Bundling your major policies, such as home and automobile, with one carrier can potentially help you save cash on both. Car insurers value their plans based upon a number of aspects.

insure money risks cheap car

insure money risks cheap car

insurers car insurance auto car insurance

insurers car insurance auto car insurance

In some cases these cost aspects increase, and also often they drop. In the majority of states, expenses are currently climbing. Your activities, as an insurance policy holder, can influence what you pay, also. If you include an additional vehicle, or a teenaged driver to your plan, your costs will boost. However there are likewise various other variables beyond your control that could create prices to raise, such as the crashes various other people are entailed in. The variety of crashes, and the expense of these collisions, are a part of car insurance coverage prices in every state. As an example, drivers staying in huge cities are most likely to pay more. In addition to all that, speed up limits are additionally being raised. Speed is the single-biggest contributor to crashes in which chauffeur error is pointed out as the reason. Sidetracked driving is a problem all over. In large cities as well as small, individuals texting, speaking or otherwise inhabited with another task while driving is being criticized partly for more collisions. It additionally covers the price of injured crash sufferers 'healthcare as well as shed wages too